Supercharge Your Encompass®

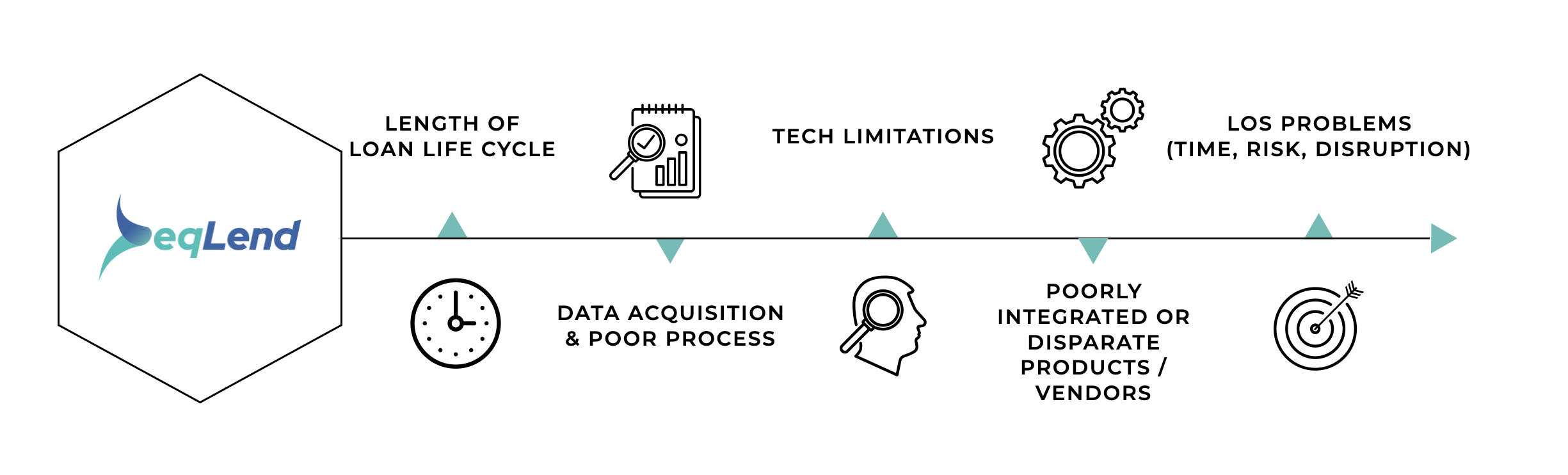

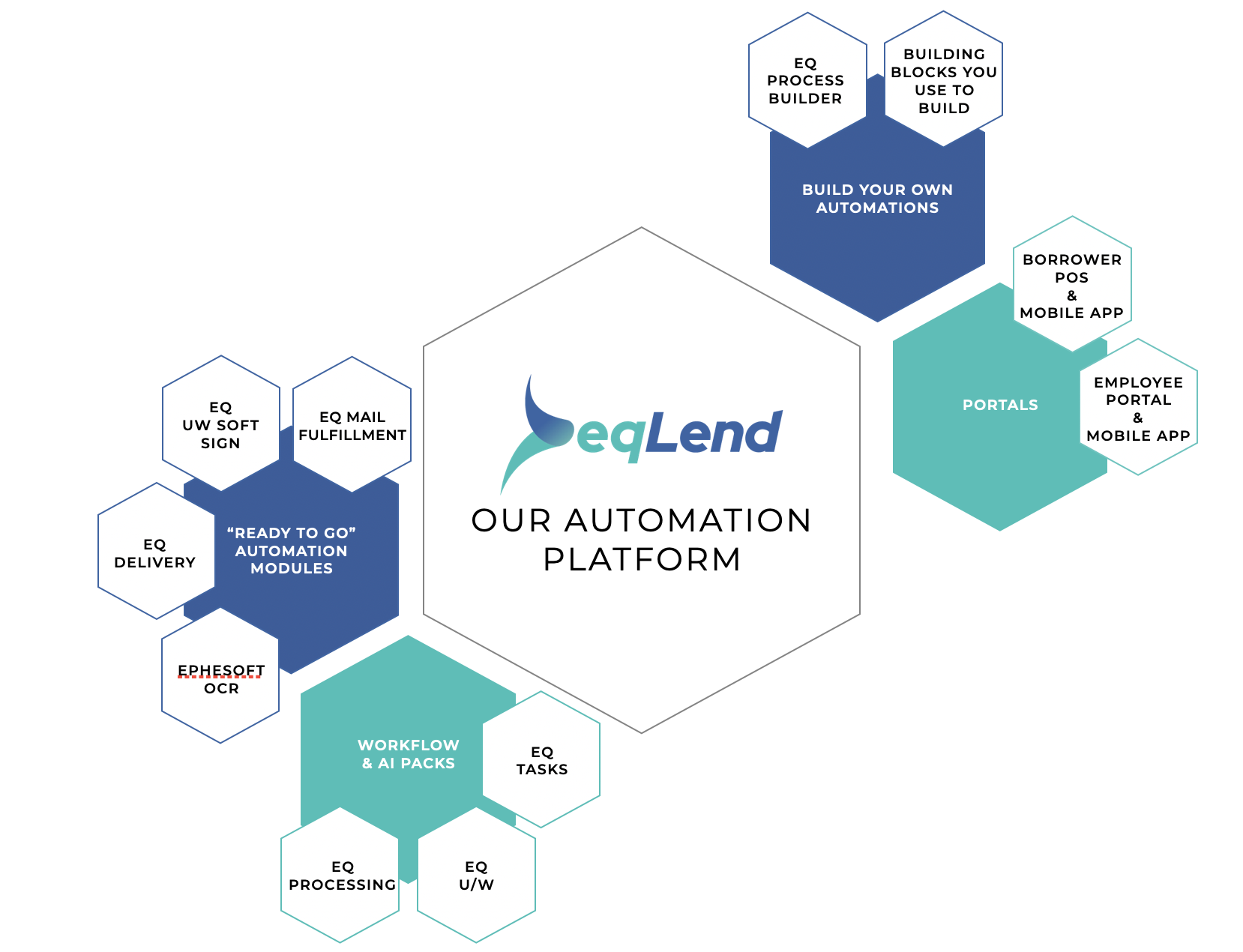

Our comprehensive solution overlays onto your existing Encompass experience, empowering you with the right tools to automate process and minimize disruption.

We've been at this awhile - 26 years to be specific...

We overlay your existing experience to

supercharge process & maximize your investment

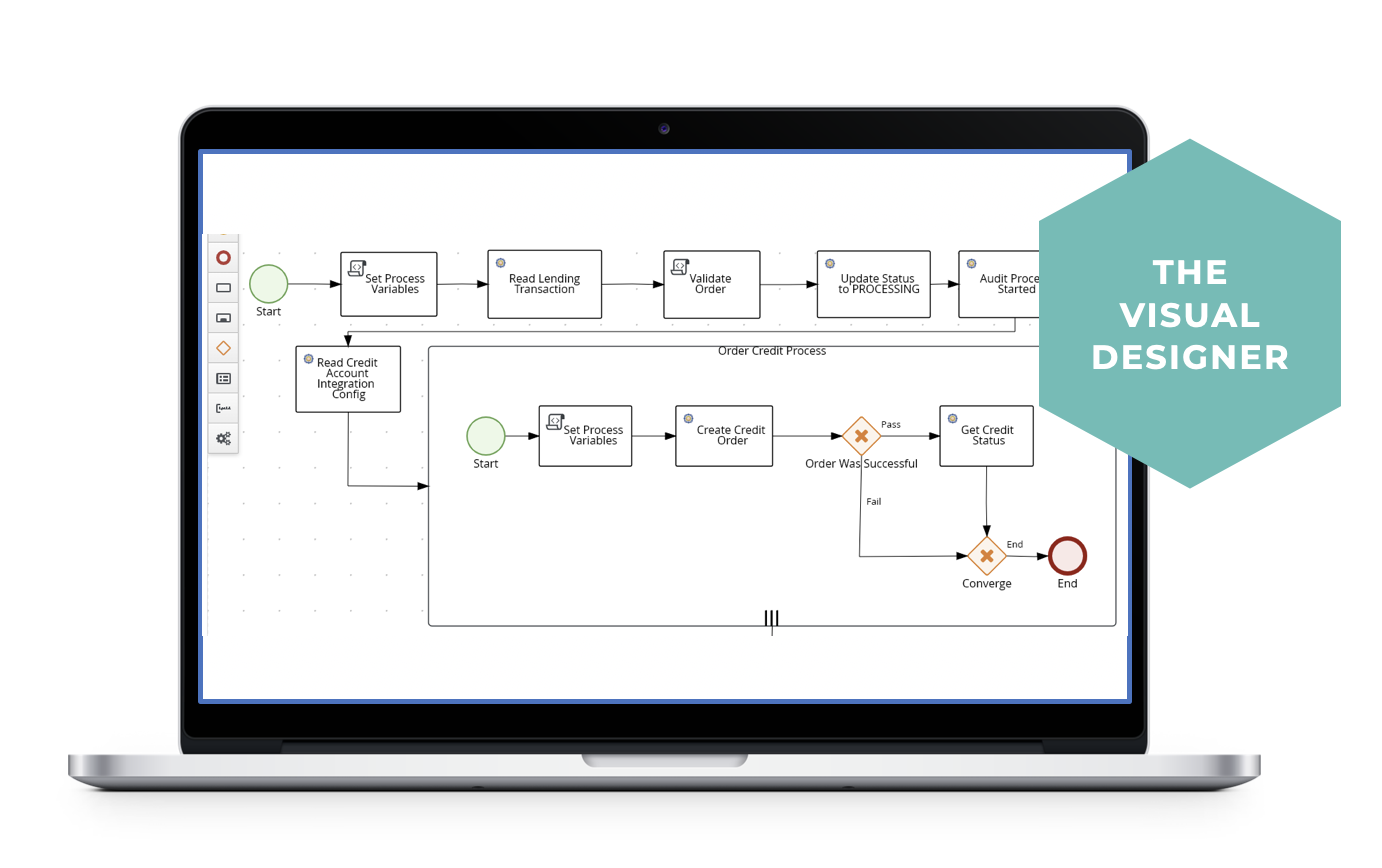

A Fully Customizable,

low-code Solution

From the most complex to the simplest loan flows, eqLend supercharges your Loan Process. Empower precise, streamlined processes & follow through.

- Create tasks & proactive prompts on your visual dashboard

- Identify issues before they are a problem

- Drive results-based decisions

- Drive workflow automation

A dynamic Solution That Simplifies Process

Our unified presentation streamlines most document-centric user tasks, and make it possible to outsource document tasks while only exposing the specific data needed for the specific tasks.

Ready-to-go workflow templates that optimize you in just 90 days!

Finally, the optimization you've been looking for.

Enhance your experience, optimize your Team & take the tediousness out of the process.

26 years of writing mortgage software

We have proudly crafted eqLend through decades of expertise in the industry.

Our comprehensive solution overlays onto your existing Encompass experience, empowering you with the right tools to automate process and minimize disruption.

1997

Wrote LOS for ABFS / Upland Mortgage

- Consumer & Business Lending

- Credit Interface

- Fee Management & Compliance

- Closing Doc System

- Fully Automated Disclosures

1999

Introduced one of the First Consumer POS on the Market

- Borrower led Deal Structuring

- Pricing & Underwriting

- Think “Rocket Loans”, but in 1999

2001

Patent US6901384B2 Automated Deal Structuring

- Consumer POS

- Wholesale Portal

- Soft Credit

- Needs Analysis & Loan Structuring

- 12 Deals offered, Underwritten, Conditioned & Priced

Today

Building countless other mortgage automation capabilities

Power up with eqLEND

Fully featured Point-Of-Sale that prompts customers, separates entered data in accordance with the law, and creates specific tasks for each borrower to streamline process.

Plus we supercharge...

& We Save You Time

We overlay your existing system, helping your team remain streamlined and focused.

Our automated processes can help your employee / processor save 20 minutes per file as you’re underwriting.